A trade reference is a report detailing the payment history between a business customer and its supplier or vendor. Trade references can be given orally, written down in a trade reference letter, or obtained by reporting payment history to commercial credit reporting companies like Dun & Bradstreet, Experian, or Equifax.

Companies and banks that lend money and extend credit want to ensure that their customers can pay their debts in full and on time. Successful businesses place equal value on exemplary trade references as they do on profits.

Please continue reading so that I can go into more detail about what a trade reference is.

The Meaning Of A Trade Reference

Trade references are useful in many different business contexts, but they are typically viewed as demands made by credit suppliers. Credit-granting institutions like banks, lenders, and suppliers require trade references from their clients. Although it is impossible to predict whether someone will pay a debt within the anticipated terms, information about prior behavior is frequently used as a good predictor.

A name and the associated contact information can serve as the reference in and of themselves. The lender in this instance calls that number and inquires about the potential borrower’s credit history. In other situations, a letter with the opinion, precise information about the past or present credit, and full contact details are required.

A trustworthy person or organization who isn’t closely related to the beneficiary should provide the trade reference. When a relative serves as a reference, it is not very useful because there may be conflicts of interest that skew the facts.

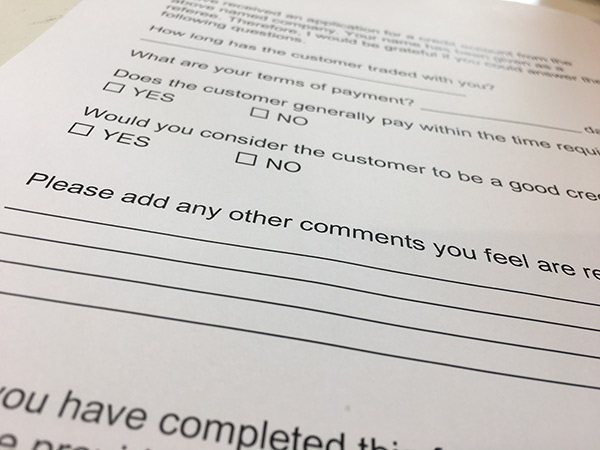

A Trade Reference Example

A trade reference might also contain the following details:

- Customer identifying information (name of business, address, etc)

- Credit terms (i.e. net 10, net 30)

- Date account opened

- Open AR balance (AR = accounts receivable)

- Past due balance

- Highest previous balance

- DBT (days beyond terms) – current and previous

- Number of late payments

- Credit limit

- Number of credit transactions

Trade Credit Pros & Cons

Pros:

- Often easy to get compared to small business loans

- Improve cash flow

- May help build business credit

Cons:

- Lower credit limits initially

- Limited purchasing options

- May not help build business credit

Be Aware Of The Downsides Of Trade References

Credit bureaus only receive automated trade references from a select group of businesses. Manually reported trade references must come from businesses and suppliers that have a history of being reliable, respectable, and based in the United States. Smaller companies may therefore appear to have much weaker credit histories than they actually do.

Not all transactions can be reported as trade references. You cannot apply if the company is one with which you already have a legal or business relationship. You cannot report transactions with banks or credit card companies that you already do business with, for instance.

Creating a solid network of trade references can take some time. Laying the groundwork for trust takes time, just like it does in any wholesome relationship. Before the vendor is willing to offer longer payment terms, a supplier and a buyer typically have a business relationship for a while.

Additionally, enough time must have passed for the two parties to show a consistent history of payments and for a company to establish its creditworthiness. Early funding and credit may be challenging if you don’t use other strategies to enhance your company’s reputation and credit.

When managing your transaction relationships, you must be careful because trade references can be unfavorable. Negative trade references are one strategy used by vendors to combat slow pay (also known as past due payments on credited transactions).

Ways To Get A Trade Reference

Dealing with businesses that let you buy goods or services and pay for them later will help you build your professional network. This arrangement frequently takes the form of “net terms,” such as “net 30 terms,” where payment is due thirty days after the date of the invoice. (Net terms may be as long as net 120 or as short as net 10. Longer terms are typically offered to well-known companies that are regarded as reliable clients.)

To businesses they trust, companies are more likely to extend credit. To assess your business’s payment history with other creditors, they may request written or verbal trade references from your current connections or they may consult business credit reports. You should work to establish business credit if your company doesn’t already have one.

Keep in mind that before extending credit, some businesses may require you to make a certain number of purchases. If your company is new, that is frequently the case.

New Businesses

New businesses may want to look for companies that offer vendor terms and are willing to work with firms that are less than two years old or don’t have a history of good business credit in order to obtain trade references.

To assist you in opening your first accounts, here is a list of simple net 30 vendors.

Existing Businesses

If you want to know if your current vendors and suppliers offer credit, start there. If they do, keep an eye on your business credit reports to see which ones include payment history. Consider working with businesses that offer vendor credit if you don’t already have any connections that will let you purchase on credit.

The Link Between Trade References And Funding

Possessing strong industry references can be extremely helpful when trying to get small business financing. When submitting a credit application for business funding, you might be asked to list the names of your vendors or suppliers so that lenders can check your record of on-time payments.

Your business’s credit score can be raised by making on-time payments to companies that provide information to business credit agencies. Obtaining funding or a business loan may be simpler for you.

When approving small business funding or loans, lenders frequently consider factors such as the length of time you’ve been in operation, your annual revenue, your personal credit score as the business owner, and your business credit.

For small business, trade references may not show the full picture.

Unfortunately, some suppliers have chosen to offer favorable trade references in exchange for cash. This is an instance of commercial credit fraud. Due to these unethical practices, some modern lenders and underwriters are less inclined to rely on favorable trade references and have shifted their credit risk assessment models to emphasize different underwriting information (such as cash flow, debt, business credit cards, and more).

Long story short: While concentrating on trade references is acceptable, you shouldn’t rely solely on them.

Making prompt bill payments, updating your company information with the major credit reporting agencies, challenging or otherwise taking action in response to late payments, and submitting regular financial reports to demonstrate your company’s soundness are additional ways to improve your business’s credit.

How Can Suppliers Avoid Asking For Business References?

Your AR team spends a lot of time managing the credit checking process as a supplier. They must persuade the client to complete the credit application, make contact with the trade references, and choose a credit limit. Even then, there is some risk involved. While there is still a chance of non-payment, floating net terms credit restricts cash flow. Digital net terms management tools like Resolve take care of the whole net terms process on your behalf. everything, including payment processing and reminders, credit checking, and financing on net terms. Manufacturer and wholesaler assistance is Resolve’s area of expertise.

Can Trade References Assist With Financing?

When applying for small business financing, strong trade references can be very beneficial. You might be asked to list the names of your suppliers or vendors on a credit application for business financing so that your payment history can be checked.

Additionally, some of the businesses you pay on terms will report payments to business credit reporting agencies. If you pay these accounts on time, you can establish business credit. (For instance, trade credit experiences have a significant impact on the Paydex score from Dun & Bradstreet.) Strong business credit is one of the elements that small business lenders may take into account when assessing loan applications from entrepreneurs looking for financing for their businesses, along with time in business, revenues, and/or personal credit scores.

If your business’s credit scores aren’t great, some vendors will accept trade reference letters or perform a verbal verification with your current suppliers. Again, this explains why they might inquire about references’ trade credit information when submitting a credit application. However, since this takes more time, start establishing business credit as soon as you can.

Note that when applying for business credit cards, trade references are not likely to be consulted. Instead, the owner’s personal credit scores are typically used to evaluate credit card applications. Additionally, it’s uncommon for banks to ask for trade references these days when extending credit, but you should be ready to provide these references whenever you apply for financing.

How Do You Establish Trade References?

It’s crucial for buyers to understand that trade references can be applied in various contexts. One supplier may decide to use credit reporting agencies, such as a Dun & Bradstreet (D&B) business credit report, experian, or equifax, to view credit ratings when you apply for credit terms with a new supplier. Another supplier may choose to call your trade references directly. You can see why it’s more convenient to check trade references given that these can cost anywhere from $50 to $150 USD.

Make Friends With Vendors And Suppliers

Building a business relationship with your suppliers is a great idea if you’re a new customer. The more familiar a supplier or vendor is with you, the more likely it is that they will serve as a trade reference. When another business requests a trade reference, they will be happy to provide you with a reference letter. Working with vendors and suppliers repeatedly—rather than just once or twice—is the key to developing relationships. You start to depend on them, and they do the same. The real relationship starts there. The two of you develop trust, just like in any healthy interpersonal relationship. As you might expect, cultivating such relationships requires time. Putting together trade references takes time, to put it another way. They want to know that you and your company are trustworthy before they agree to let you use them as a trade reference. It is much simpler to obtain 30 or 60 day net terms from a supplier than it is to obtain a business loan to improve your cash flow.

Pay Your Bills On Time

It’s crucial to always pay your supplier and vendor bills on time in addition to establishing trust. It would be ideal if you could pay a little earlier. You might not interact with a vendor as frequently in some circumstances. There isn’t much room for interpersonal interaction when transactions are mostly conducted online. You want to maintain a good credit standing with your suppliers.

However, consistently making payments on time will speak highly of your credibility and be very persuasive. At some point, something beyond your control might cause you to miss a payment. If you have a strong payment history, one late payment is unlikely to have a negative impact on your standing with that specific supplier or vendor.

Ask Vendors And Suppliers To Register With D&B

A business equivalent of a credit bureau is Dun & Bradstreet (D&B). D&B is a great resource for credit checks on businesses when a party like a bank, supplier, client, or insurance company wants to do so. Each company that registers with D&B receives a DUNS Number, a special identification code only used by D&B.

D&B business credit is not automatic, in contrast to personal credit bureaus. To create a credit profile with D&B, you must first sign up and obtain a DUNS Number. Afterward, D&B must regularly receive your payment history from your suppliers and vendors.

Some companies automatically report payment experiences to D&B. You’ll need to ask those who don’t to share their payment experiences. Occasionally, a decision regarding a vendor or supplier may be made based on whether or not they automatically submit payment experiences to D&B.

You can calculate your PAYDEX score once you have at least three trade references from D&B. Similar to a personal credit score is the D&B PAYDEX score. A high PAYDEX score can give you access to credit lines from suppliers and vendors as well as lower interest rates and insurance premiums.

If you value credit, building trade references may be essential to your company’s success. You are a low credit risk if you have a history of on-time payments. Due to this, businesses will be more inclined to give you credit. Lack of industry references may result in worse credit terms and higher loan interest rates. Looking for a trade reference template? Numerous are accessible online for no cost.

Why Should A Company Ask Its Partners For Trade References?

Trade recommendations can help your company extend credit and receive payments on time, as well as help it obtain credit in the first place. You are extending credit if your company plans to deliver products or services without receiving payment in full upfront. As a result, it’s possible that your customers will ask you for business trade references. If you can, try to fulfill these demands. Avoiding unnecessary risk when extending credit, it benefits both your customers and other businesses.

Naturally, it’s crucial to obtain a credit application from each customer you give trade credit to in order to assess their creditworthiness and decide how much risk you are willing to assume. Think about looking into their company’s credit history as well. (You don’t need to ask your customers’ permission in order to check a business’s credit.) Consider extending a smaller amount of credit to potential borrowers if their credit scores aren’t great until they can show they’ll make their payments on time.

You might want to think about informing commercial credit bureaus like Dun & Bradstreet, Equifax or Experian as well as the Small Business Financial Exchange about your customer’s payment history. Make sure your clients are aware that you file credit reports for your business; this will encourage timely payment. Your clients’ ability to establish business credit will be aided by reporting.

Effect Things Of Business Credit Ratings & Scores

- Pay your company’s bills on time or early, including any invoices for trade credit.

- Utilize D-U-N-S Manager, a free tool from Dun & Bradstreet, to make sure that your company’s information is up to date.

- To dispute overdue payments or legal events that you feel are inaccurately listed in your file, use D-U-N-S Manager.

- To show the health of your company, send Dun & Bradstreet your financial reports.

Can Any Company Manually Submit A Trade Reference To Dun & Bradstreet?

For a variety of reasons, including but not limited to the following, some Trade References submitted proactively through the CreditBuilder product might not be accepted:

- Some businesses fail to respond to Dun & Bradstreet’s information requests in a timely manner or at all. The submission won’t be accepted if Dun & Bradstreet is unable to contact a Trade Reference. The customer can, however, proactively resubmit references at any time for verification, in which case Dun & Bradstreet will make further attempts to get in touch with your Trade Reference in order to gather the Payment Experience data for potential acceptance.

- The business already automatically informs Dun & Bradstreet of payment details.

- The business seems to be unreliable.

- In its database, Dun & Bradstreet does not contain enough details about the business to confirm its legitimacy or other aspects.

- Due to company policies, Dun & Bradstreet cannot receive information about Payment Experience.

- The business has no US physical presence.

Trade References do not include payments that are anticipated.

How Are Trade References Evaluated?

Trade references are also referred to as credit references, particularly by commercial credit bureaus like D&B and Experian. Credit bureaus can assess your creditworthiness using trade references and your payment history.

The PAYDEX score is a credit scoring system used by D&B. Despite being specifically for businesses, this score resembles your personal FICO credit score. The PAYDEX score is on a scale of 0 to 100. A score of at least 70 is considered good, and a score of over 80 indicates a very low credit risk, resulting in some of the best credit terms.

How To Manually Submit Trade References To Dun & Bradstreet?

The only method for manually submitting Trade References* is through Dun & Bradstreet’s CreditBuilder product. Your payment history will be requested from the relevant vendor by Dun & Bradstreet. If accepted, the payment experience might have an effect on the credit scores and ratings of your company.

A Concierge Manager can provide businesses with devoted support if they so choose. To free up your time to manage your business, these experts in business credit can assist with the details of potentially establishing your business credit file.

Trade Reference Submission Key Components

Let’s take a closer look at the supplier or vendor providing the trade references; specifically, their experiences with payments. Every submission to D&B is accompanied by seven pieces of data.

Past Due Total

The total amount of past-due balances, as defined by the vendor’s credit terms. If a balance is unpaid after the due date, it will be deemed past due and reported.

With this data point, vendors are free to be flexible. For instance, if a payment is only five or ten days overdue, it might not be counted toward the overall amount of past-due payments. The vendor may or may not include some past-due payments at its discretion.

Sales Terms

the conditions set forth either at the time credit was first granted or most recently. Terms include the total amount of credit, the number of days before payment is due, the bare minimum that must be paid with each payment, and any early discounts.

Credit terms like net 30, 60, and 90 can change. If the customer consistently pays on time, the terms might be extended. On the other hand, terms may shorten, lowering risks for the vendor, if the client consistently misses payments or sees a decline in the performance of their business.

Last Sale Date

gives information on the most recent customer transaction. Creditors can use this information to determine whether a customer is still using a particular vendor’s credit.

Reporting Date

The payment experience is merely submitted to D&B on this date. A reporting date or as-of date is included with every submission to D&B.

Method Of Payment

It refers to the customer’s chosen payment method and is also known as the manner of payment. This can be a wire transfer, check, business credit card, ACH, or even cash.

Higher Amount Of Credit Used In 1 Year

This represents the highest balance a client had due to the vendor over a 12-month period. Assume that a customer has $10,000 in vendor credit. Their unpaid balance typically falls between $3,000 and $5,000. But for three months, it increased to $8,000. In the submission, the reported amount for this data point is $8,000.

Other creditors can ascertain a customer’s usage of issued credit by using it as a trade reference data point. Customers who use nearly all of their available credit could pose a greater risk than those who use less than half of it.

Total Amount Owed

merely the total balance due at the time of submission.

FAQs

What Is Trade Reference Example?

Here is some of the information that may be included with a trade reference: Customer identifying information (name of business, address etc) Credit terms (i.e. net 10, net 30)

Who Can I Use As A Trade Reference?

Unlike utilities like phone and electric service, which are typically creditors and suppliers within the industry, trade references are suppliers and creditors. The best sources of information are primary references, such as manufacturers of computer hardware and raw materials.

What Is A Trade Reference On An Application?

A Trade Reference is a report detailing the payment history between a business customer and its supplier or vendor. Trade references can be given orally, written down in a trade reference letter, or obtained by reporting payment history to commercial credit reporting companies like Dun & Bradstreet, Experian, or Equifax.

How To Get A Trade Reference?

You get trade references by doing business with companies that allow you to purchase goods or services and pay for them later. This arrangement is often in the form of “net terms” such as net 30 terms where payment is due in thirty days after the invoice date.

What If I Don’t Have A Trade Reference?

Without trade references, suppliers might not want to take the risk of giving you credit. Better deals and terms are likely to be offered to you if your references are stronger. Suppliers will want to continue doing business with you if you can demonstrate your dependability.

How Are Trade References Different From Trade Credit?

When a company offers trade credit, another company can buy goods or services from that company without making a down payment. The outcome of that relationship is the trade reference, or how that customer manages that credit. You receive trade credit, and the likelihood that the business will give you a favorable trade reference is based on your payment history. The two are intricately linked.

Without Good Personal Credit, Am I Still Able To Obtain Trade References?

The good news is that you can establish trade credit without having excellent personal credit. Some businesses that offer trade credit won’t even look at the business owner’s personal credit reports. Others may do a “soft check,” to rule out very low personal credit scores. In other words, even as you improve your personal credit, you might be able to secure credit with suppliers.

The Best Way To Request A Trade Reference

You’ll frequently get in touch with the lender’s credit management division to ask for a trade reference. Before listing your suppliers or vendors as a trade reference on a credit application, it’s a good idea to check with them to ensure you have the correct contact information. This is especially important if you are a business owner.

What Are Some Additional Ways To Raise Business Credit Scores?

Trade references aren’t the only way to establish business credit; they can also be a very effective one. The majority of business credit cards report to at least one of the major commercial credit reporting agencies, so using one of these cards is another way to establish business credit. Additionally, a lot of small business lenders report to business credit.

Final Words

The article concentrated on the definition of a trade reference.

Lenders and business-to-business suppliers who must decide whether to extend credit to the applicant must consider trade references as a key factor. These references are typically in addition to a formal credit report by an established business credit-rating agency such as Dun & Bradstreet

So, now that you’ve read the post, do you know what a trade reference is? Please post a comment if you have any queries about what constitutes a trade reference. I’ll get right back to you.

Finally, I want to thank you for reading.